KEY HIGHLIGHTS

- Simplify Ownership: Clear steps to remove hypothecation, ensuring full vehicle ownership.

- Step-by-Step Guide: Obtain NOC, visit RTO, submit documents, pay fees, and receive updated RC.

- Smooth Transition: Transition words enhance readability, guiding you through the process effortlessly.

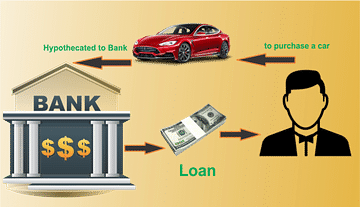

What is Hypothecation?

An asset is pledged as collateral to secure a loan or debt, referred to as hypothecation in legal and financial terms. The asset remains the borrower's property under this arrangement, but the borrower provides the lender the right to seize and sell the asset if the borrower defaults. Hypothecation is frequently used in many finance situations, including auto loans and mortgages. As they have a claim on the asset in case of a borrower defaults, it gives the lender some security. The borrower gains from potential lower interest rates because of the offered collateral.

What is Hypothecation Removal?

Removing a hypothecation or lien on an item, generally a car, pledged as security for a loan is known as hypothecation removal. When a loan is used to acquire a car, the lender inserts a hypothecation mark on the registration certificate (RC), signifying ownership rights over the asset until the debt is ultimately returned. Once the debt has been paid off, the hypothecation must be removed. It entails filing the necessary documentation, such as loan closure papers, to the RTO where the car is registered. The RTO validates the papers and changes the RC, eliminating the hypothecation mark and designating the borrower as the sole owner of the asset. The elimination of hypothecation gives the borrower complete ownership of the car, allowing them to freely sell, transfer, or modify it without any restrictions. It also increases the car's resale value and gives the borrower a feeling of financial independence.

What is the Car Hypothecation Termination Process?

Removing a car hypothecation is essential to transfer vehicle ownership from the lender to the owner. You must go to your local RTO office to do so. After you have completed all of the required requirements, the RTO will give you a new registration certificate (RC) book stating that you are the sole owner of the car.

While finalizing a vehicle loan is comparable in some respects to closing a house loan, there is an extra step needed. In addition to notifying the lender of the loan's termination, you must also apply with the Regional Transport Office (RTO) because the RTO has to amend its records and remove the hypothecation marking from the RC.

You may ensure that you have entire ownership of your car and enjoy the advantages of being its single owner by following the right procedure and completing the hypothecation removal.

Why is Hypoth5cation R5moval Important?

Removing hypothecation (HP) from your vehicle's registration certificate (RC) after completely repaying the loan provides numerous significant advantages. Some primary benefits of HP termination or removal from the RC are:

- Increased Resale Value: A car that has not been hypothecated often has a better resale value than a hypothecated vehicle. Prospective buyers prefer automobiles with clean titles and no encumbrances, which may draw more fantastic offers and boost your chances of selling your car for a fair price.

- Vehicle Purchases with No Hassle: Future operations involving your car, such as ownership transfer, re-registration, or securing loans against the vehicle, become more accessible and quicker without hypothecation. Because there is no hypothecation, there is no need for extra documentation or verification procedures linked to the lender's participation.

- Loan-Free Standing: Removing HP from the RC indicates that you have successfully redeemed the loan and are no longer liable for any financial obligations related to the car. It gives you a feeling of success while relieving you of the weight of recurring debt commitments.

- Insurance Versatility: Many insurance companies provide lower prices for automobiles that are not hypothecated. Following HP removal, you can choose insurance plans that best meet your requirements and budget, perhaps saving you money on insurance prices.

- Confirmation of Ownership: The removal of HP indicates your full car ownership. The RC without the hypothecation mark gives you exclusive rights and control over the vehicle, enabling you to sell, transfer, or modify it without the lender's limitations.

- Peace of Mind: Having a clean RC with the HP removed provides peace of mind since you know you have total control over your car. You can use and manage your car without any legal or financial constraints.

Also Read: The Benefits of Nitrogen for Tyres: Enhancing Performance and Safety

How to R5mov5 Hypoth5cation from RC?

To remove hypothecation from your vehicle's Registration Certificate (RC), follow the procedures below:

Step 1: Loan Closure: Ensure that you have completely repaid your auto loan and received the proper loan closure documentation from the lender. A loan closure letter, a No Objection Certificate (NOC), and a hypothecation termination form are common examples of these papers.

Step 2: Gather the Required Documents: The required documents will vary from state to state. Still, they typically include the following:

A completed application form

A copy of your RC

A copy of th5 No Obj5ction C5rtificat5 (NOC) from th5 l5nd5r

Proof of insuranc5

Proof of addr5ss

Step 3: Pay a Visit to the RTO: Visit the Regional Transport Office (RTO), where you registered your car. Inquire about the unique hypothecation removal technique and prerequisites.

Step 4: Document Submission: Submit the required papers to the RTO's authority. This often comprises loan closing documentation, the original RC, identification and address verification, pictures, insurance documents, and the PUC certificate.

Step 5: Pay any applicable fees, including a hypothecation removal cost, a smart card fee, and any additional charges stated by the RTO. Inquire with the RTO about the actual charge amount and payment procedure.

Step 6: Verification and Processing: The RTO will review the documentation you supplied and handle your request for hypothecation removal. This may include verifying the legitimacy of the documentation and physically inspecting the car.

Step 7: Wait for the RTO to process your application. The RTO will typically take a few weeks to process your application.

Step 8: Coll5ct th5 N5w RC: Onc5 th5 RTO has proc5ss5d your application; you will b5 issu5d a n5w RC with th5 hypoth5cation r5mov5d.

Hypoth5cation, a necessary security measure for lenders, can complicat5 v5hicl5 own5rship with limitations on own5rship, high5r insuranc5 pr5miums, and 5xtra pap5rwork. Y5t, by understanding and following th5 hypoth5cation r5moval proc5ss, owners can simplify their 5xp5ri5nc5. By adh5ring to th5 proc5dur5, individuals can obtain a n5w RC without hypoth5cation, freeing th5m to sell or transfer ownership of th5ir v5hicl5 hassl5-fr55.

Stay up to date with all the automotive news and updates by joining our 91Wheels Whatsapp Group today!