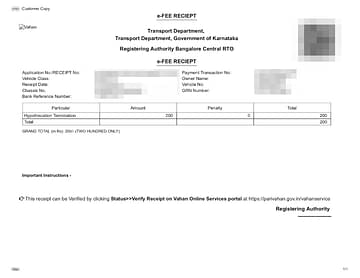

Updated on April 19, 2021 - In this article, you will get to know what are hypothecation charges and should you pay more for them. You can also check the cancellation of hypothecation from your RC by clicking HERE.

Original Article - July 25, 2020; Buying a car is everyone's dream, be it a budget hatchback or a full-size SUV. While having a car is a necessity these days, there is a theory that one should not buy a car on a Loan. It attracts hypothecation and further charges. Well, should you buy a car on a Loan? Or via cash? We answer your query.

If you see the car-buying culture in India then almost all people pull up a loan to buy their car. In most cases, the bank finances the car till 85%-90% and then you pay the remaining amount. Here, what happens is there are some hypothecation charges which the bank charges and in the RC too, the bank is the owner of the car.

Let me first tell you about what does Hypothecation means? Suppose if you own a car and opt for the financing schemes. Then the majority of the money is provided by the bank and in that case the original paper and in the RC also, the bank is the rightful owner of your car. This is done to make sure that the required EMIs are duly filled with time and there is no delay in them.

Also Read: Affordable Automatic Compact SUVs Which Costs Less Than Rs 10 Lakh

So that means that your car is an asset to them and the bank enjoys the possession of the car until you have paid all the interest money to the bank. The payment can be done before the time period also and you can get the complete ownership of your car in the RC.

Hypothecation charges are paid by the customer because they are opting for the loan of their car. If you are buying your car with the direct flow from your account to the required dealership account then you need not pay the hypothecation charges. It is only done in case if you finance the car from the bank. However, some car showrooms end up adding this cost in the final on-road price and this is the reason why you must keep an eye on the complete break-up of charges.

Also Read: 2020 Maruti Suzuki S-Cross Petrol Bookings Open; Launch Soon!

Currently, the hypothecation charges are as high as Rs 1500 for a car and Rs 300 to Rs 500 for two-wheelers. This updated rule is from 2017 and now you might have to check with the dealer and the bank as to what are they charging currently.